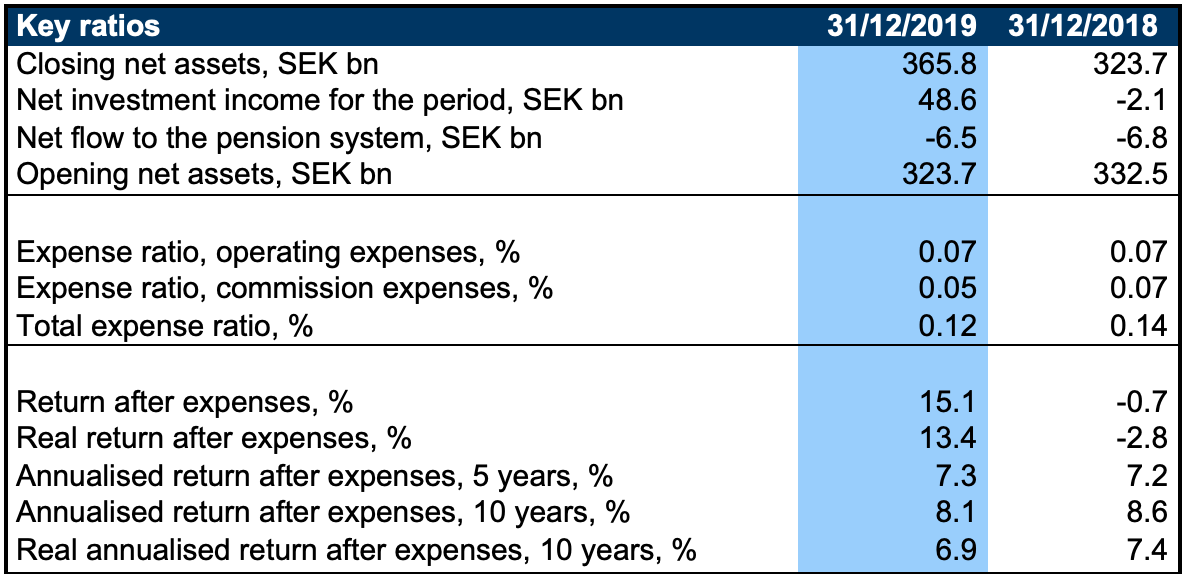

Första AP-fonden’s (AP1’s) net investment income for 2019 amounted to SEK 48.6 billion after expenses. This equates to a return of 15.1 per cent, the highest annual return in a decade. Total net assets amounted to SEK 365.8 billion at the year-end. The strong result for 2019 means that the average annual real return after expenses for the past ten-year period is 6.9 per cent, which well exceeds the Fund’s target of 4.0 per cent.

Acting CEO Teresa Isele comments:

“Our aim is to create the best risk-adjusted return for Sweden’s pension recipients, so I am delighted to see a return of 15.1 per cent for 2019. It means that we are exceeding our long-term targets by a good margin. In the longer term, we believe that market returns will slow, and we have therefore adjusted our medium-term, ten-year real return target from 4 per cent to 3 per cent. We have also introduced a long-term real return target of 4 per cent over a 40-year period. At the end of last year, we decided to develop our asset management with new equities strategies and a new organisational structure. These changes lay a better foundation for achieving our return targets, while also reducing our annual costs.”

“During the year we have taken several important steps as regards sustainability. They include adopting a new sustainability strategy and a new climate strategy, developing the model for calculating and monitoring the carbon footprint in our portfolio, and establishing a Sustainability Committee within the Board of Directors. We want our sustainability management to improve our risk-adjusted return, while progressively reducing our portfolio’s carbon footprint to become carbon-neutral by 2050. Along with the Council on Ethics of the Swedish AP Funds and other institutional investors, we have been involved in many important investor initiatives during the year. For instance we have taken action to fight the fires and prevent deforestation in the Amazon, and to improve safety in the mining industry. It is also pleasing to see that we have once again been recognised for our sustainability management internationally, with several distinctions from e.g. Institutional Investor Europe (IIE), the UN’s Principles for Responsible Investment (PRI), and the Nordic Fund Selection Awards.”

Download AP1’s 2019 Annual Report here.

Contact:

Teresa Isele, Acting CEO AP1, phone +46 (0)8-566 20 256.

Sara Christensen, Head of Communications AP1, phone +46 (0)70-968 12 50, sara.christensen@ap1.se